Changes to the Tax Bonus for Paid Interest

Below, we provide you with an overview of the most significant changes resulting from the amendment to the Income Tax Act.

Advantages for Micro-taxpayers

The concept of a micro-taxpayer was introduced into the Income Tax Act in 2021 and brought several exemptions from certain tax obligations, simplified administrative procedures, thereby creating a favorable environment for small and starting businesses.

Until the end of 2023, a person whose taxable income did not exceed EUR 49 790 for the taxable period was considered a micro-taxpayer if the statutory conditions were met.

The change in 2024 increased the decisive threshold for taxable income (revenue) from

EUR 49,790 to EUR 60,000. Achieving this value represents a loss of various benefits for the entrepreneur, including a 15% income tax rate or favorable rules for asset depreciation and the deduction of tax losses.

The value of EUR 60,000 will be applied for the first time in the tax period beginning on

January 1, 2024. This means that the fulfilment of the micro-taxpayer status for the 2023 tax period is assessed according to the conditions valid until December 31, 2023, i.e., a maximum income (revenue) of EUR 49,790.

Exemption for Employee Stock Ownership Plans (ESOP)

The adopted amendment brought an exemption from personal income tax for non-cash benefits provided to employees in the form of employee stock or business share in their employer's limited liability company after December 31, 2023. However, the law conditions the exemption on two simultaneous requirements, which must be met:

- the employer did not distribute profit shares (dividends) from the date of registration for income tax until the end of the tax period in which this benefit was acquired by the employee and

- the acquired employee shares must not have been, and must not be, traded on a regulated market (exchange) until the end of the tax period in which this benefit was acquired by the employee.

This exemption for such non-monetary benefits applies not only to employees but also to collaborating individuals in connection with their business performance or other self-employed activity for the company.

In practice, meeting the condition of not distributing dividends is usually applicable primarily to so-called startups. We must also not forget to emphasize the non-exemption from income tax in cases where employee shares are granted to a holding company abroad, for which, however, Slovak employees do not perform any activities.

Changes to the Tax Bonus for Paid Interest

For new mortgage agreements concluded after December 31, 2023, new rules will apply regarding the tax bonus for paid housing loan (mortgage) interest. The main change is the application of the tax credit for paid housing loan interest for one property (apartment, house) intended for residential purposes solely for the taxpayer's own permanent residence with close relatives. Under the new rules, taxpayers will no longer be able to claim the tax bonus for paid housing loan interest on an investment property that is rented out.

The taxpayer's age limit of a minimum of 18 years and a maximum of 35 years at the time of applying for the loan, remains unchanged. However, the income threshold is increased from the original 1.3 times the average monthly wage of an employee in the Slovak economy for the calendar year preceding the year in which the loan agreement was concluded, to 1.6 times this wage. This means that the taxpayer can claim the tax bonus for paid interest on the loan only if their income does not exceed this limit. In the case of a co-debtor, the sum of the average monthly income of the debtor and the co-debtor cannot exceed 2 x 1.6 times the average monthly wage.

Another favorable condition for the application of this tax bonus is that the maximum amount of the tax bonus has been expanded to cover the entire amount of the loan and will not be capped at a maximum of EUR 50,000, with the maximum bonus amount being EUR 1,200 instead of EUR 400.

Taxpayers will be able to claim all these changes in their tax return for the year 2024 based on a confirmation issued by the bank upon their request.

Special Tax Bonus for Increased Loan Instalment

A significant novelty is the introduction of a tax bonus on increase of the paid instalment, where the taxpayer can improve their income by up to EUR 1,800.

Taxpayers can claim this tax bonus for the year 2023 if they do not claim the tax credit for paid interest in the version effective until December 31, 2023. The tax bonus on the increase in the instalment paid applies to housing loan agreements concluded no later than December 31, 2023, and can be claimed for:

- one housing loan

- one domestic property (apartment, house) intended for residential purposes solely for the taxpayer's own permanent residence

Another condition is the average monthly income of the taxpayer for the year 2022, which is at most in amount of EUR 2,086.40 (1.6 times the average monthly wage for the year 2022). In the case of the existence of a co-debtor, the sum of the average monthly income of the debtor and the co-debtor cannot exceed EUR 4,172.80 (2 x 1.6 times the average monthly wage for the year 2022). There is no age limit for the taxpayer in this case.

The tax bonus for increased loan payments can also be claimed for loans that were refinanced in the past.

The amount of the tax bonus depends on when the repayment amount changed. The state reimburses up to 75% of the difference between the average annual instalment paid in the tax period of 2022 and the higher instalment paid in the tax period of 2023, up to a maximum of EUR 1,800 per year or EUR 150 per month. The necessary document for the correct determination and claiming of this tax bonus is the Confirmation according to § 26b of the Housing Loans Act, which is issued upon the taxpayer's request.

Higher Tax on Dividends

Among the less popular changes approved within the consolidation package is primarily the increase in the withholding tax rate on the payment of dividends to individuals from the original 7% to 10% for profits earned for tax periods beginning no earlier than January 1, 2024.

This increase applies to both Slovak and foreign owners of Slovak companies. In the case of dividends paid to a foreign resident, it is necessary to consider the double taxation avoidance agreement as well.

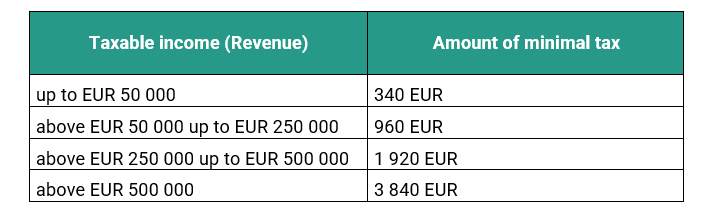

Reintroduction of Minimum Tax for Legal Entities

As of January 1, 2024, the minimum tax for legal entities, also known as the tax license, which was applicable in Slovakia from 2014 to 2017, is reintroduced. This obligation affects many entities and aims to improve the state of public finances.

The minimum tax for a legal entity is an income tax that the legal entity will pay after deducting tax allowances and subtracting tax paid abroad for each tax period, in which:

- the tax liability calculated in the tax return is lower than the amount of the minimum tax set for individual legal entities, or

- the legal entity incurs a tax loss.

The amount of the minimum tax depends on the taxable income (revenue) of the legal entity.

There is a possibility of reducing the minimum tax, which a legal entity can reduce by half if the proportion of its employees with disabilities is at least 20% of the total average registered number of employees.

Additionally, there are exemptions where selected legal entities are not obligated to pay this minimum tax (for example, a group of taxpayers who are not established or set up for business).

The obligation to pay the minimum tax for a legal entity arises for the first time for the tax period beginning on January 1, 2024.

Increase in the Upper Limit of Exempt Income from Charitable Advertising

Non-profit organizations utilize revenues from various sources for their activities, including advertising. According to the Income Tax Act, advertising is considered taxable income. However, to support the financing of the non-profit sector, it is possible to claim an exemption from income tax specifically for these revenues.

The amount of income exempt from income tax on advertising for charitable purposes is increased from EUR 20,000 to EUR 30,000. This exemption can be claimed by civic associations, foundations, non-investment funds, non-profit organizations providing generally beneficial services, purpose-built facilities of churches and religious societies, organizations with an international element, the Slovak Red Cross, and research and development entities.

Rule on the Limitation of Interest Expenses

Another change in the law is the introduction of a new rule limiting the interest expenses of legal entities. This rule, which came into effect at the beginning of 2024, has a significant impact on companies that use loans and borrowings to finance their activities. Its aim is to prevent artificial reduction of the corporate income tax base through debt financing.

The rules on limiting interest expenses apply to net interest expenses arising from contracts concluded after December 31, 2023, including amendments concluded after December 31, 2023, to contracts concluded by December 31, 2023. These rules need to be applied preferentially over the rules of low capitalization, and in the event of their application, the original rules of low capitalization will no longer apply.

The limitation of interest expenses applies to legal entities whose net interest expenses, which represent the positive difference between interest expenses and interest income, exceed the amount of EUR 3,000,000. In such a case, the legal entity will be required to increase the tax base by net interest expenses exceeding 30% of the value of the so-called tax EBITDA indicator.

Net interest expenses not included in tax deductions due to the application of rules on limiting interest expenses can be deducted from the tax base in the following five consecutive tax periods, under the condition that the total amount of net interest expenses included in the tax base in each tax period will not exceed the limit of 30% of the tax EBITDA.