Child tax bonus

The child tax bonus is provided as an amount that an eligible taxpayer can deduct from their tax liability if they meet the conditions set out in Act No. 595/2003 Coll. on Income Tax. The conditions for obtaining a tax bonus are usually based on the number and age of children, as well as on the taxpayer's income. From 1 January 2025, new rules on the child tax bonus come into force, which bring significant changes compared to the rules currently in force. These legislative changes will affect the entitlement to the tax bonus, its amount and other conditions that taxpayers must meet to claim it.

Effective from 01.01.2025:

- Change in the age limit for entitlement to the tax bonus Until 31 December 2024, parents were entitled to

a tax bonus for dependent children up to the age of 25. However, from 1 January 2025, this entitlement

will be limited to children under 18 years of age. This step represents a fundamental change that will

narrow the circle of eligible taxpayers.

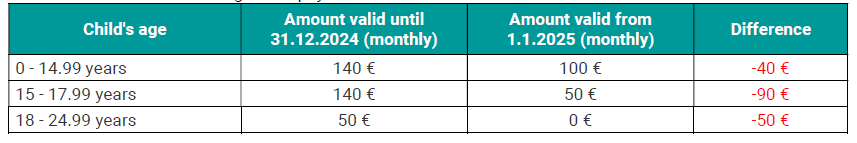

- Reduction of the maximum amount of the tax bonus. The maximum amount of the tax bonus will be reduced from €140 to €100 per month per child from 2025. This reduction will affect all parents who claimthe tax credit, which may significantly reduce their total annual entitlement.

- Gradual reduction of the bonus depending on income. The amount of the tax bonus in 2025 will alsodepend on the amount of the taxpayer's income. If the taxpayer's monthly income exceeds the amount of EUR 2,480, the amount of the tax bonus will begin to decrease. With an income of €3,632 and above, the entitlement to the tax bonus will cease to exist completely.

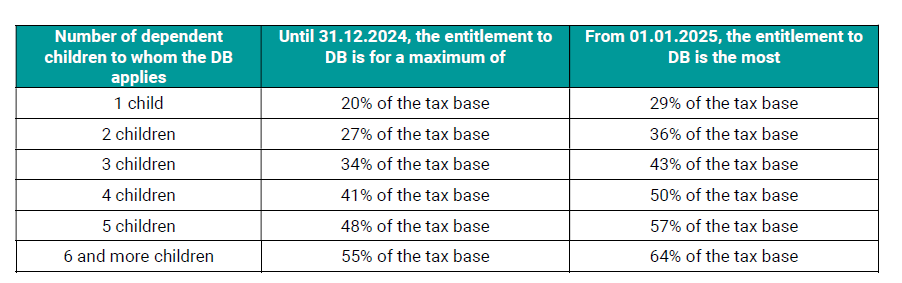

- Increase in the limit for the full application of the bonus depending on the number of children. The new rules increase the percentage limit of the amount of the tax base to which the full entitlement to the taxbonus applies. This limit will change depending on the number of children. For example, for one child, the limit will increase from 20% to 29%, for two children from 27% to 36%, and so on.

- Limitation of entitlement to a tax bonus for Slovak residents with income from abroad. The new rules extend the condition that taxpayers must achieve at least 90% of their taxable income in the territory of the Slovak Republic. So far, this condition has only applied to tax non-residents of the Slovak Republic, but from 2025 it will also apply to Slovak tax residents. In practice, this means that if a Slovak resident works abroad, for example in the Czech Republic, and has no income in Slovakia, he or she will not be entitled to a child tax bonus.

At the same time, the following continue to apply:

1. if the parents have more than one child, only one of them can claim all the children (the children cannot be

divided between the parents at the same time for the application of the DB ),

2. one of the parents can claim the tax bonus for part of the year, the other for part of the year,

3. If the parents do not agree on who will claim the tax bonus, then the mother has priority

Application of the tax bonus

An employee can decide whether to claim the tax bonus with his employer during the tax period monthly or only

after its end, i.e. once a year (through the institute of Annual Tax Settlement or Tax Return) If an employee claims a tax bonus with the employer, the entitlement is proved by the child's birth certificate and by filling out the Income Tax Declaration form.

In the case of a child who has already completed compulsory school attendance, and this child is considered as

dependent (e.g. studying at a secondary school), the employee is obliged to submit, in addition to the birth

certificate, the following:

1. confirmation from the school that the child is constantly preparing for a profession by studying

2. or a certificate from the Office of Labour, Social Affairs and Family on receipt of the dependent child

allowance

3. or a certificate from the Office of Labour, Social Affairs and Family that the child is considered to be

dependent and cannot continuously prepare for a profession by studying or performing gainful activity due

to illness or injury

In case that the employee's entitlement to the child tax bonus expires, it is necessary to notify the employer with

whom the employee has claimed this bonus so far. Such a notification must be provided in writing - it must be

stated on page II in the Statement on the application of the non-taxable part of the tax base and tax bonus (in part

IV - Changes in the data stated in the declaration).