Simplification of corporate restructurings: What does the new Act on Conversions of Commercial Companies and Cooperatives bring?

On June 28, 2023, the National Council of the Slovak Republic approved Act No. 309/2023 Coll. on Conversions of Commercial Companies and Cooperatives and on amendments to certain acts (“Act”). The Act entered into force on March 1, 2024. Following the adoption of this new Act, amendments were made to the Accounting Act, the Income Tax Act, and the Value Added Tax Act.

The reason for adopting the Act was the transposition of Directive (EU) 2019/2121 of the European Parliament and Council of November 27, 2019, which amends Directive (EU) 2017/1132 regarding cross-border conversions, mergers or acquisitions, and divisions.

The legislative regulation of corporate transformations was previously contained in the provisions of Act No. 513/1991 Coll., the Commercial Code. With the adoption of the new Act, the relevant provisions in the Commercial Code have been removed. The main goal of the new Act is to create a unified, coherent and clear legal framework for transformations, cross-border conversion, and changes in legal form for all types of companies and cooperatives.

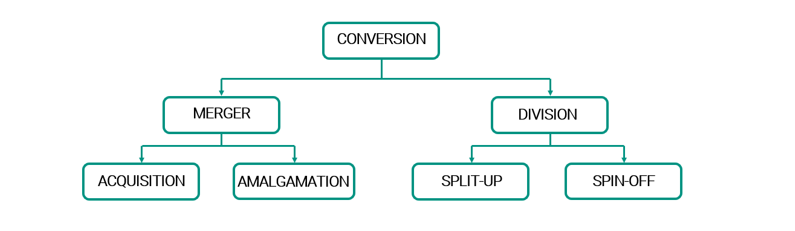

Basic types of national conversion

In connection with the adoption of the new legal framework, new terms have been introduced into Slovak law. The key new term is “conversion”, which includes (1) mergers and (2) divisions. A merger comprises either (A) an amalgamation and (B) an acquisition. For divisions, there are two types: (a) a complete division, known as a "split-up," and (b) a partial division, referred to as a “spin-off “. The Act also defines cross-border conversion, where at least one party involved is a Slovak company or cooperative, and at least one party is a foreign company.

Source: own processing

All types of conversions require the preparation of a draft of conversion project, which will replace the acquisition agreement and the amalgamation agreement in the context of merger legislation. The draft of conversion project must be prepared jointly by the statutory bodies of the participating companies and must be verified by a certified independent auditor.

The next section of the article is dedicated to an entirely new concept, the “spin-off“ of a company.

Spin-off

The Act comes with changes that were required by the application practice and introduces, into Slovak legal order a completely new term concept of a partial division known as a “spin-off”.

A spin-off is a procedure in which the divided company does not cease to exist, and a part of the company´s assets specified in the conversion project is transferred to a legal successor, which may be:

- one or more existing companies (known as a “spin-off by acquisition”)

Source: own processing

- one or more newly established companies (known as s „spin-off by amalgamation “)

Source: own processing

A spin-off, which involves the transfer of part of the capital, is not permitted for all types of companies – it applies exclusively to limited liability companies and joint stock companies. Additionally, a spin-off is not possible if on a decisive day the company's equity is lower than its share capital.

The decisive day is a key moment stated in the conversion project, from which the accounting operations of the divided company are considered to be operations of the successor company. However, in the case of a spin-off, this effect applies only to the assets and liabilities that are transferred to the successor company according to the conversion project.

A spin-off of a company represents a simplification of corporate reorganizations. Unlike previous practices, this new institute allows not only the spin-off of an entire business or part of it, but also the transfer of a specific selected part of assets, which provides companies with wider flexibility in optimizing their corporate structure.

Changes in other Acts that were adopted in connection with the Act on Conversions of Commercial Companies and Cooperatives

In connection with the adoption of this Act, several tax acts and the Accounting Act have been amended and modified. An overview of some of these changes is provided below.

Value Added Tax Act

The amendment to the VAT Act, effective from March 1, 2024, introduces the following changes:

- Acquisition of taxpayer status ex lege

A taxable person to whom the tangible or intangible assets of another taxpayer that was divided by spin-off are transferred in the domestic territory, becomes a taxpayer according to Section 4 (4) (e) of the VAT Act as of the date of the conversion. The taxpayer is required to notify the tax authorities of this fact within ten days from the date of the conversion.

- Acquisition of taxpayer status for a foreign entity

A foreign entity becomes a taxpayer if it acquires tangible or intangible assets in Slovakia from another taxpayer that has either been dissolved without liquidation, split by spin-off, or have been divided by a cross-border spin-off, but only under the condition that the taxable person remains a foreign entity for VAT purposes (i.e., it does not establish a permanent establishment in Slovakia). The taxpayer is required to notify the Bratislava Tax Office of this fact within ten days.

Income Tax Act

Effective from March 1, 2024, Section 13c of the Income Tax Act is amended, specifically by the addition of letter (f), which extends the existing income tax exemption (participation exemption”) on the sale of shares or business interests to also cover cases of spin-offs, thereby broadening the original provision. For the purposes of spin-offs, the date of acquisition of a direct interest is considered to be the date of entry into the Commercial Register, which is when the effects of the company spin-off take place.

At the same time, the Act has been adjusted with rules regarding tax base adjustments in cases of spin-offs, such as the mutual offsetting of receivables and liabilities, adjustments to valuation differences, and so on. A taxpayer undergoing a spin-off shall adjust their tax base in the taxation period ending on the day preceding the decisive date.

Accounting Act

In connection with the conversions of commercial companies, the Accounting Act has been amended as follows:

- The decisive day is defined as the date specified in the conversion project, and from this date the actions of the dissolving accounting entity are considered from the point of view of accounting as actions performed on behalf of the successor entity.

- If the legal form is changed in accordance with the Act on Conversions of Commercial Companies and Cooperatives and the legal successor is a Slovak accounting entity, it is required to prepare interim financial statements as of the effective date of the change.