Legislative changes from 01.01.2025 for the payroll accounting

- Minimum wage

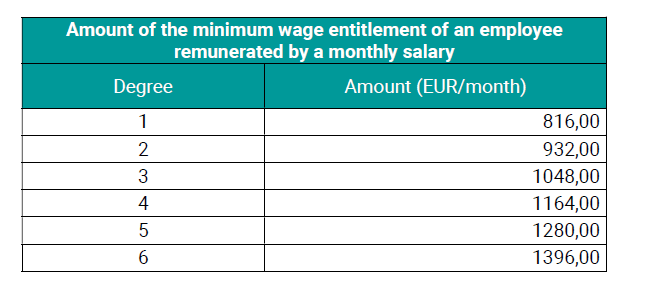

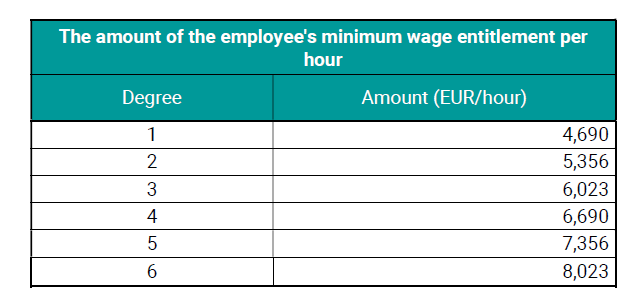

Increase of the minimum wage from 01.01.2025

Monthly minimum wage for the 1st degree of work difficulty = EUR 816.00

Hourly minimum wage for the 1st level of work difficulty = EUR 4.690

Respecting and applying the right degree of difficulty in practice is essential

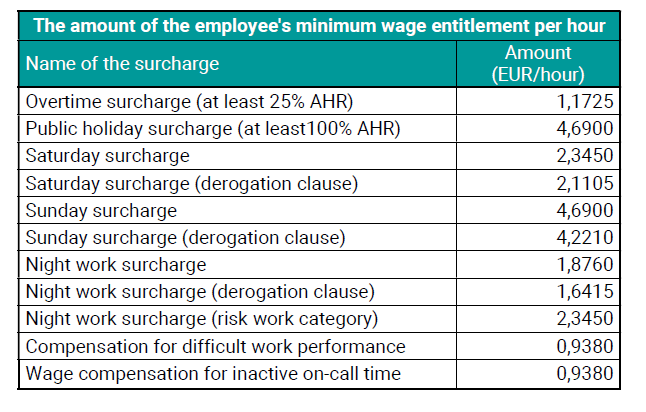

- Payroll surcharges

- Contribution to the child's sports activities

From 1 January 2025, it is mandatory for employers with more than 49 employees (it is mandatory for

employers employing 49.1 employees or more). It is voluntary for employers with up to 49 employees.

To determine the number of employees, it is necessary to base it on the statistical report P2-04 for the

previous calendar year, namely on the average registered number of employees.

The contribution is in the amount of 55% of proven expenses, up to a maximum of €275 for 2025 on a

full-time basis. In the case of part-time employment, the maximum possible amount of the

contribution is aliquot reduced.

- Agreements for seasonal work in tourism

With effect from 1 January 2025, agreements on work activities for the performance of seasonal work

may be concluded in tourism in the operation of restaurants and pubs and in the operation of

accommodation facilities - regardless of whether they are linked to the transport of people on rivers,

etc., the rental of sports equipment, the operation of camps, artificial water bodies or cable cars and

ski lifts, etc.

Abolished condition of direct dependence of the performance of work activity on the operation of

activities

- Social Insurance

Increase in the maximum assessment base

The maximum monthly assessment base will be €15,730 from 01.01.2025 (in 2024 it was €9,128)

Abolition of parental pensions

From 1 January 2025, parental pensions under Sections 66b and 66c of the Act, which were

introduced in 2023 and 2024, will be cancelled. Pension recipients will be partially compensated for

this by the possibility of donating 2% of the tax paid by children to their parents (see changes in the

Income Tax Act).

- Health insurance

During 2025, the minimum advance payment of an employee is the sum of:

- an advance payment for the employee's insurance premiums, which is calculated as 4% of €273.99 - without taking into account the deductible item, which is the amount of €10.95,

- advance payment of employer's insurance premiums for such an employee, which is calculated as 11% of €273.99 - without taking into account the deductible item, which is the amount of €30.13.

The minimum advance payment of an employee during 2025 is €10.95 + €30.13 = €41.08.

Contribution deductible item 2025

It is still max. €380 per month. For an income above €380 per month, it is reduced by twice the

difference between the income and the amount of €380. For incomes from €570, the PPE is zero.

Since January 2018, PPE has only been applied to employees. PPE does not apply to the employer.

Contribution deductible item to DoBPŠ - 200 € remaining Contribution deductible item to DoPV and

DoVP for pensioners - 200 € remaining

Levy relief for seasonal work - change to € 715 (50% of the average monthly wage from two years ago

- Income tax

Amount of the non-taxable part of the tax base for 2025 - €479.48 (monthly), €5,753.76 (per year)

Tax rate – tax bands

- 19% of the tax base up to and including 176.8 times the amount of the applicable subsistence

minimum, i.e. up to €48,441.43 (per year), €4036.79 (per month)

- 25% of the tax base exceeding 176.8 times the applicable subsistence minimum, i.e. exceeding €48,441.43

- Non-monetary income of an employee who uses an employer's motor vehicle with

an electric drive for business and private purposes

According to Section 5 (3) (a), the non-monetary taxable income of an employee in connection with the

use of the employer's motor vehicle for business and private purposes is defined.

In order to promote electromobility, the amount of in-kind income in the case of an electric vehicle (i.e.,

PHEV = Plug-in hybrid vehicle or BEV = battery electric vehicle) is reduced from 1% to 0.5% of the entry

price of this vehicle.

- Reduction of the dividend tax rate to 7%

Pursuant to the fifth point of Section 15(a) and Article 43(1)(a), the tax rate on profit shares (dividends)

paid to natural persons is reduced from 10% to 7%.

A reduction in the rate to 7% will be applied to profit shares (dividends) recognized from profit or loss

calculated for a tax period starting no earlier than 1 January 2025.

Dividends paid out from the profit or loss reported for the 2024 tax period will be subject to a 10% tax rate.

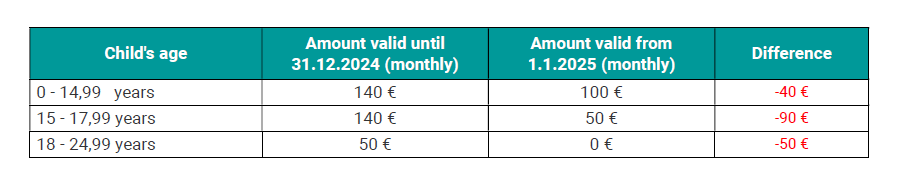

- Changes in the child tax bonus

Change in the age limit for entitlement to the tax bonus Until 31 December 2024, parents were

entitled to a tax bonus for dependent children up to the age of 25. However, from 1 January

2025, this entitlement will be limited to children under 18 years of age. This step represents a

fundamental change that will narrow the circle of eligible taxpayers.

Reduction of the maximum amount of the tax bonus The maximum amount of the tax bonus will be reduced from €140 to €100 per month per child from 2025. This reduction will affect all parents who claim the tax credit, which may significantly reduce their total annual entitlement.

- Gradual reduction of the bonus depending on income The amount of the tax bonus in 2025 will also depend on the amount of the taxpayer's income. If the taxpayer's monthly income exceeds the amount of EUR 2,480, the amount of the tax bonus will begin to decrease. With an income of €3,632 and above, the entitlement to the tax bonus will cease to exist completely.

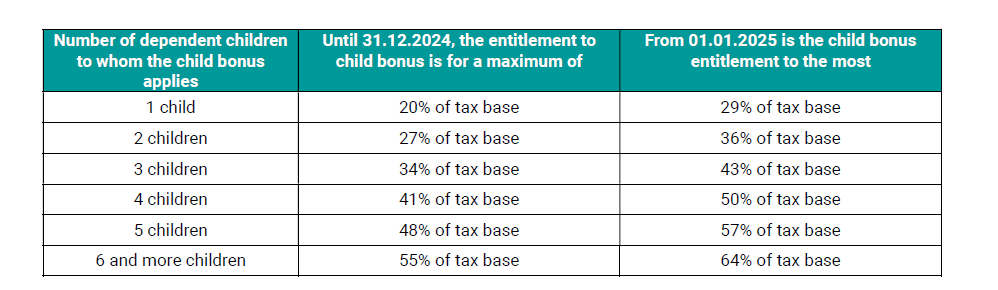

- Increase in the limit for the full application of the bonus depending on the number of children The new rules increase the percentage limit of the amount of the tax base to which the full entitlement to the tax bonus applies. This limit will change depending on the number of children. For example, for one child, the limit will increase from 20% to 29%, for two children from 27% to 36%, and so on.

Limitation of entitlement to a tax bonus for Slovak residents with income from abroad

The new rules extend the condition that taxpayers must achieve at least 90% of their taxable income in the territory of the Slovak Republic. So far, this condition has only applied to tax non-residents of the Slovak Republic, but from 2025 it will also apply to Slovak tax residents. In practice, this means that if a Slovak resident works abroad, for example in the Czech Republic, and has no income in Slovakia, he or she will not be entitled to a child tax bonus.

Do you need advice in this topic?