The deadline for filing the tax return for motor vehicle tax and property tax is approaching

Individuals and legal entities affected by this obligation are obliged to submit a motor vehicle tax return for the year 2023 by 31 January 2024 and to pay the tax within the same period. For the 2024 real estate tax, the obligation to submit the tax return is also due by 31 January 2024.

Motor vehicle tax for 2023

Motor vehicle tax is regulated by the Motor Vehicle Tax Act. There have been no legislative changes compared to last year.

Who is required to file a motor vehicle tax return for 2023?

Taxpayers of the motor vehicle tax are legal entities and individuals who in 2023 used a vehicle of category L, M, N and O registered in the Slovak Republic for business or other self-employed activity. The taxpayer is also an employer who reimburses an employee with a travel allowance for the use of a vehicle that is not used for business purposes.

When does tax liability arise and cease?

The tax liability normally arises on the first day of the month when the vehicle registered in the Slovak Republic was used for business purposes. However, in special cases, the tax liability may arise on a different day, for example if the taxpayer acquires a vehicle from another taxpayer, then the tax liability does not arise until the first day of the following month.

The tax obligation ceases on the last day of the month when the vehicle is removed from the vehicle registry in the Slovak Republic, the business is terminated or interrupted, the Police Force issues a confirmation that the vehicle has been stolen, the taxpayer is dissolved without liquidation, the transfer of possession of the vehicle is recorded in the vehicle documents or the employee (or other person) ceases to use the vehicle for the taxpayer's business.

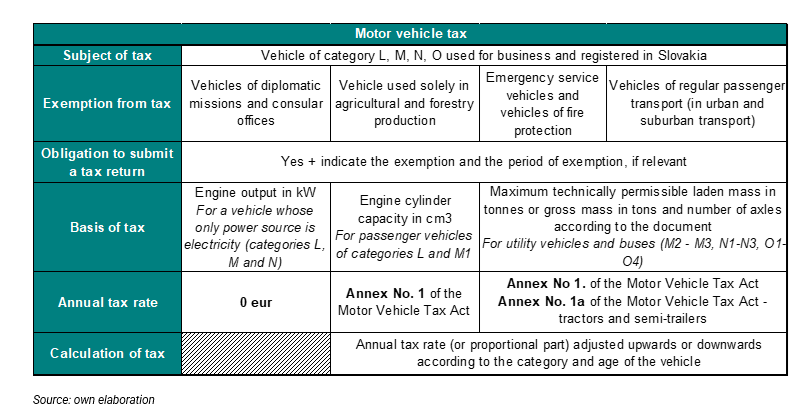

The following table provides basic information regarding the assessment of the tax:

Real estate tax for 2024

The real estate tax is regulated by the Act on Local Taxes and Local Fee for Municipal Waste and Minor Construction Waste. The specificity of this tax lies in the fact that it is filed for the tax period of the current year, i.e. the tax is paid for a year in advance and the tax return is filed only in case of a change (purchase, sale, change of purpose of use, etc.).

In the tax return, the taxpayer only provides the data necessary for the calculation of the tax for the tax administrator, which are cities and municipalities depending on the cadastral area in which the property is located. The tax administrator then sends the taxpayer a decision on the assessment of property tax, broken down into land tax, tax on buildings and tax on apartments and non-residential premises.

Taxpayers whose tax liability arose before 31 August 2023 (e.g. due to the acquisition of real estate by inheritance or auction) will use the original form template to fulfil their obligation. However, there is also a new form template, that will be used for taxpayers whose tax liability arises no earlier than 1 September 2023, including all those taxpayers who file their 2024 property tax return by the standard deadline of 31 January 2024 due to changes during 2023.

Who is considered a taxpayer for real estate tax?

The taxpayer for land, buildings, apartments and non-residential premises may be the owner, administrator, natural or legal entity who has been assigned to manage the replacement land allocated from the land fund used by the legal entity until the implementation of land adjustments, as well as tenants of real estate.

If it is not possible to determine the taxpayer, the taxpayer is the person who actually uses the land or building.

When is a taxpayer obliged to file a tax return and when does tax liability arise and cease?

The real estate tax return is filed only in the event of a change, and the status as of 1 January 2024 is decisive. If there is no change during the year 2023, there is no need to file a tax return.

Changes that may occur during the year that lead to a tax liability include: sale, purchase, exchange, inheritance, auction acquisition, change of the purpose of use of the building/apartment, change of the ratio of the use of areas, final building permit, final decision on the final approval of the building, final decision on the approval of the change of the building before its completion, final approval for early use of the building, lease, administration, change of the type of land in the land registry, change of the area, cancellation of joint ownership, demolition or removal of the building, and other facts that lead to changes.

The taxation period for real estate tax is the calendar year, except the acquisition of real estate by auction and inheritance, where the tax liability arises during the year and the tax return is thus filed during the taxation period. In other cases, the tax liability arises on 1 January of the following tax year and the tax return is filed by 31 January.

The tax liability ceases on 31 December of the relevant year in which the taxpayer ceases to own, manage, lease or use the property.

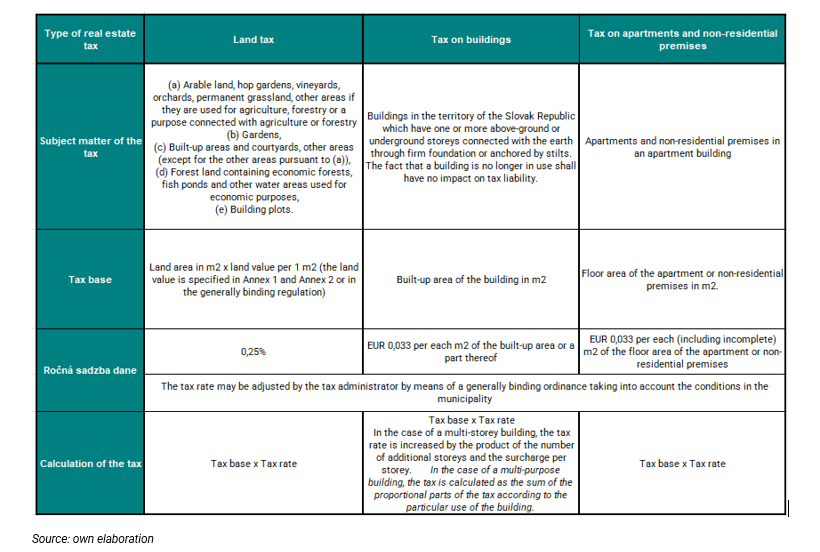

The following table gives an overview of the different types of taxes with regard to the subject of the tax, the tax base, the annual tax rate and the calculation of the tax.

Finally, we note that the tax return also includes data on the dog tax, the tax on vending machines and the tax on non-gaming machines, if relevant for the taxpayer.