Trends in transfer pricing tax audits

In the past, we informed you, that in addition to large multinational companies, transfer pricing is also gaining popularity among smaller companies, sole traders and tax administrations, which was also related to the growing trend in the number of tax audits focused specifically on transfer pricing. Although this growing trend was stopped for a while by the pandemic, however, based on the information published by the Financial Administration, it is clear that in 2021 their number started to grow again and we assume that their number will continue to increase.

This trend and the popularity of transfer pricing is also evidenced by the recent action of the Financial Administration, when the Financial Administration sent questionnaires regarding transactions with related parties to selected tax subjects to fill out. You can find more about financial administration questionnaires for transactions with dependents here.

Given the importance that the Financial Administration gives to transfer pricing, we would like to inform you about current trends in tax audits focused on this area.

Transfer documentation as evidence

The correctness of the method used in determining prices in audited transactions is checked by the tax administrator or the Financial Directorate, usually during a tax audit. The tax administrator or the Financial Directorate bases the tax audit on transfer pricing documentation. Consistently prepared transfer documentation can serve tax subjects as an initial defense tool that the prices used in transactions with related parties were determined in compliance with the principle of an independent relationship.

It is important to note that the tax administrator or the Financial Directorate is entitled to invite the taxpayer to submit the transfer documentation, and the taxpayer is then obliged to submit it within 15 days from the date of delivery of the invitation. Due to the shortness of this period and the difficulty of preparing the documentation, we recommend always preparing the transfer documentation after the end of each tax period.

Trends in tax audits

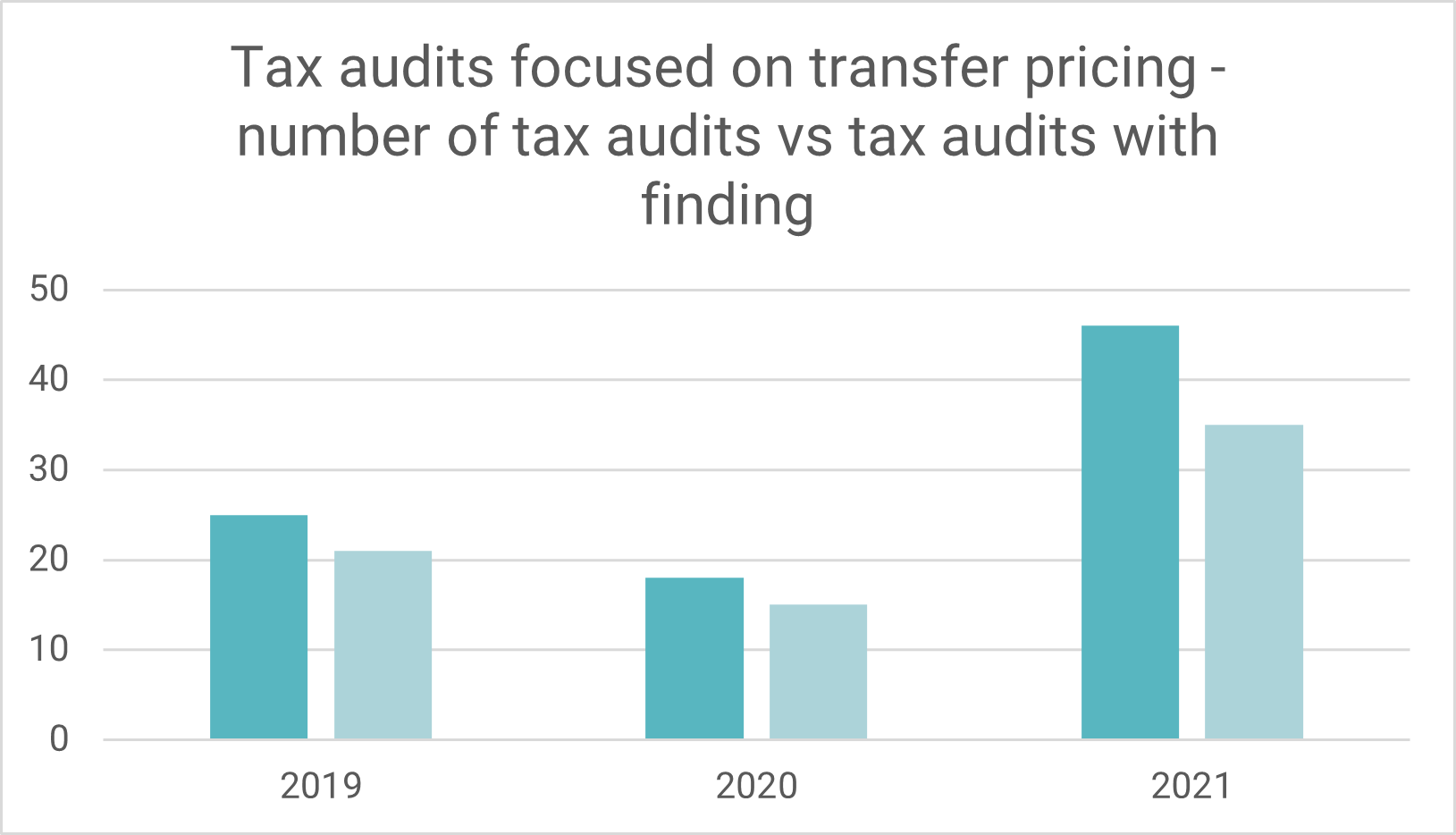

Tax audits focused on transfer pricing have been carried out for a long time. Despite the fact that their number decreased slightly during the pandemic, in 2021 we record another significant increase, especially in terms of the number of completed tax audits with a finding.

From 2014 to 2021, at least half of the tax audits carried out and completed each year resulted in a finding, while in recent years it was at least 76%. The effectiveness of the tax office regarding the detection of deficiencies and incorrect price setting in transactions between dependent persons is thus undeniable, which is also evidenced by the values of the findings themselves.

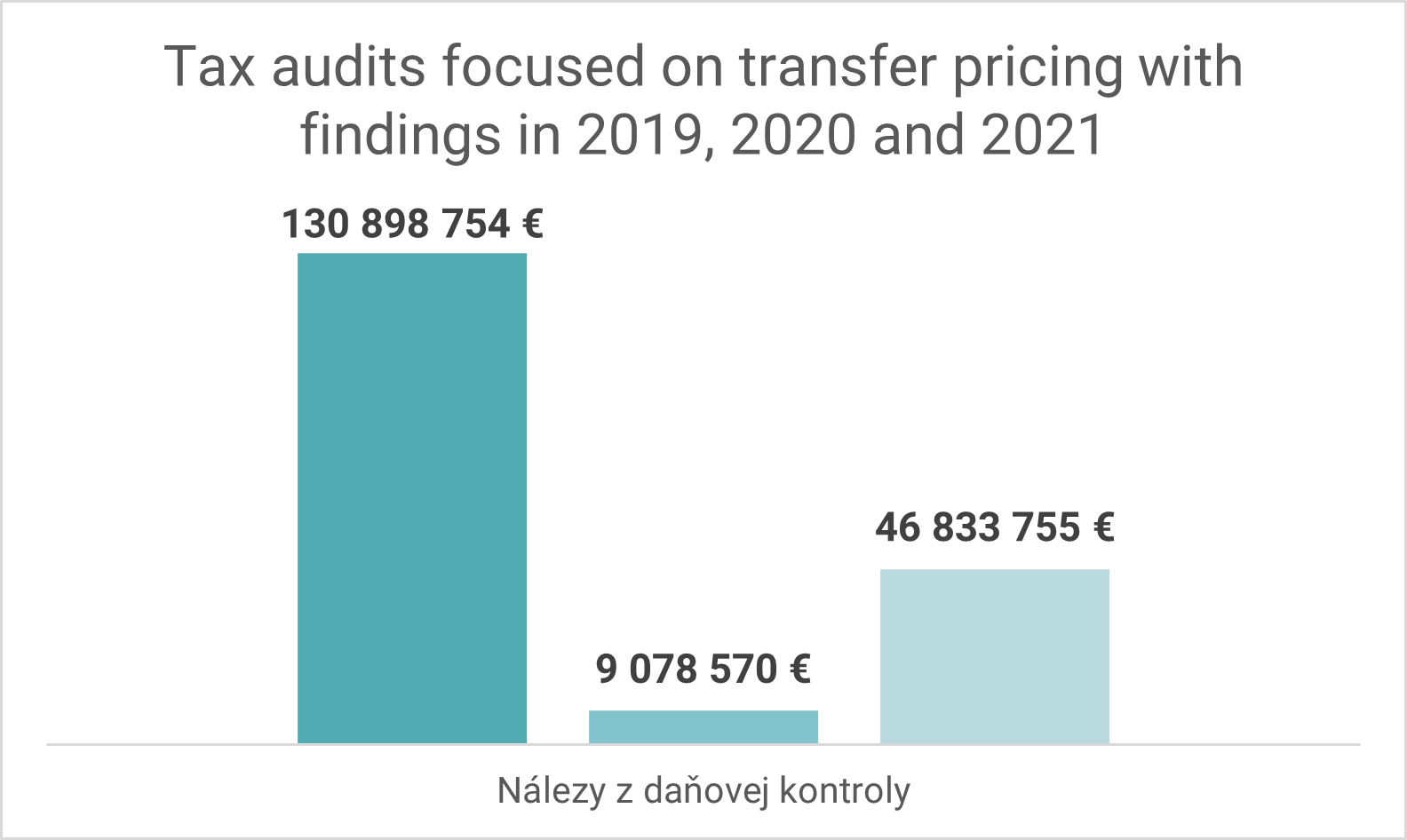

The amount of finds reaches several million euros per year. The value of the average finding for one tax audit focused on transfer pricing with a finding is also not negligible. For 2019, this average value was around 6.2 million euros, for 2020 around 0.6 million euros and for 2021 around 1.3 million euros.

The seriousness of the procedure of tax authorities in tax audits is also confirmed by the fact that reviewed decisions related to corporate income tax, in which international taxation and transfer pricing were dealt with, were in all cases confirmed in appeal proceedings. Of course, if you do not agree with the opinion of the tax authority and the appeal body, there is room to file an administrative action in court and demand a review of the tax authority's procedure by an independent court.

Good advice at the end

Based on our practical experience, it is clear that a period of 15 days is not enough to prepare such transfer documentation, which would not raise any questions for the tax administrator and end the inspection without additional questions. Therefore, we recommend that tax subjects prepare the transfer documentation in time, before the tax administrator has started the timer.