Tax rules of taxation of vouchers have been fully started

Effective from 1 October 2019, they were reflected in the Slovak Value Added Tax Act in the Act of the National Council of the Slovak Republic. (“VAT”) rules on taxation of vouchers that can be exchanged for goods or services, which apply to those vouchers that were issued after 30 September 2019. The voucher may be in paper or electronic form.

Pursuant to the EU Directive transposed into the Slovak VAT Act, a voucher is an instrument that entails the obligation to accept it as consideration for the supply of goods or services, or the related documentation specifies the goods or services to be supplied, including the conditions of use. This arrangement does not apply to those vouchers which entitle the holder to a discount on the purchase of goods and services, which do not entail the right to obtain goods or services, as well as travel tickets, cinema tickets, museums, postage stamps and similar instruments.

In terms of value added tax, there are two types of vouchers:

1. Single-use vouchers

2. Multipurpose vouchers.

A single use voucher is a voucher when it is known:

• The place of delivery of the goods or services; and

• VAT payable on these goods and services at the rate applicable to the goods and services in question.

Unless the responses to the previous two points are clear from the voucher or underlying transaction, then the voucher is not considered to be a single purpose, but a multi-purpose one.

A multi-purpose voucher is therefore any voucher other than a single purpose voucher.

Determining whether a voucher is single-use or multi-use is very important as the payment of VAT is different for each type of voucher.

For a single purpose voucher, each transfer of a single purpose voucher is taxed by the taxable person and this transaction is considered a supply of goods or services. The handing over of the goods or the supply of the service for the single-purpose voucher submitted is no longer considered as a separate transaction in terms of value added tax. Thus, VAT is levied on individual transfers of a single purpose voucher.

A multipurpose voucher within the meaning of the taxation rules shall be taxed at the moment of the actual delivery of goods or services for a multipurpose voucher. Individual multi-purpose transfers are not subject to VAT, as is the case with a single-use voucher.

From the basic examples presented by the Financial Report of the Slovak Republic in its methodological instruction, we choose two examples for illustration:

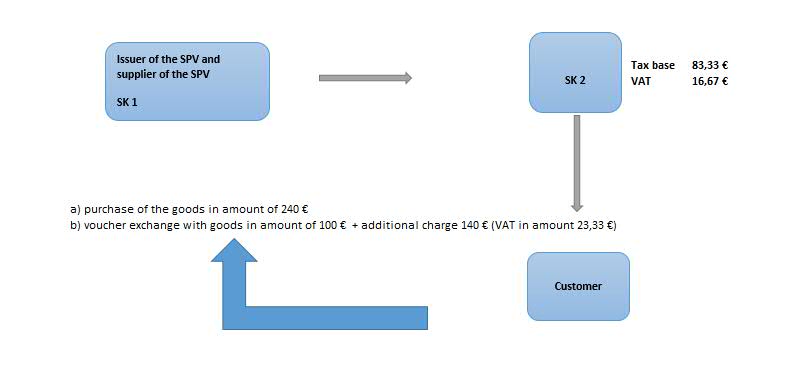

Example # 1: Diagram of the basic functioning of the single purpose voucher

SK1, a supplier of wine, issued a single-purpose voucher with a nominal value of € 100 (tax base 83.33 + tax 16.67). SK1 sells the SK2 voucher for 85 €, while the SK1 exhibitor incurred a tax liability of € 14.17. SK2 deducts € 14.17 and sells the voucher for € 100 to the customer, while SK2 incurs a tax liability of € 16.67. The customer buys SK1 wine at a sale price of 240 € [a)], exchanges a voucher for goods worth 100 € and pays 140 € [b)]. SK1 incurs a tax liability only of a supplementary payment of € 23.33.

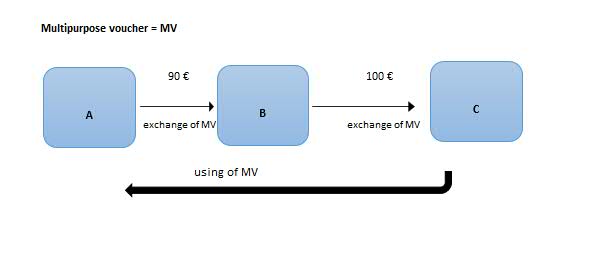

Example # 2: Diagram of the basic functioning of the multipurpose voucher

Trading Company A, which trades on different goods subject to different tax rates, sells multipurpose vouchers with a nominal value of € 100. At the time of issuing the voucher, the tax due on the delivery of the goods is not known. The voucher was bought by company B for 90 € and the voucher was bought by company C for 100 €.

Company C bought goods from Company A at the price of 240 € (goods with 20% tax for 150 € + 30 € tax and goods with 10% tax for 54,55 € + 5,45 € tax) and redeemed the voucher.

The sale of the voucher does not impose any tax liability on A and B until the actual handover of the goods by A to the customer C for the voucher is subject to value added tax at the rate of tax applicable to the individual goods.

240 € (VAT: 150 €, VAT: 30 € + VAT: 54,55 €, VAT: 5,45 €), of which 100 € voucher and 140 € cash.

The issue of vouchers is extensive and depends on case by case for individual tax assessment. Do not hesitate to contant our advisor for more information. Please, visit our website, facebook page or Linked-In.