Tax Insurance and taxation of cryptocurrencies

1 Approved Tax Insurance Act

From the passed Tax Insurance Act, we present you the most significant principles:

- By the enactment of the law, the compulsory contribution from insurance was replaced by an insurance tax.

- Subject of the tax is insurance in the non-life insurance sector (for example: accident insurance, sickness insurance, land transport damage insurance, liability insurance, property damage insurance, credit insurance, legal expenses insurance, guarantee insurance, assistance services). The exact delimitation of individual types of non-life insurance is given in Annex no. 1 to the approved Tax Insurance Act.

- The subject of the tax is insurance with the insurance risk located in Slovakia. The tax burden will be put on the payment of insurance premiums paid on the basis of a concluded insurance contract.

- Reinsurance is excluded from the subject of the tax under this Act.

- The taxpayer is generally the insurer.

- The tax is calculated from the payment of the premium, which includes tax = the principle of calculation of the tax in the field of indirect taxes.

- The rate of tax is set at 8%, with the exception of insurance against liability for damage caused by the operation of a motor vehicle.

- The calculated tax is mathematically rounded down to 0,005 euros downwards and from 0,005 euros upwards.

- The taxable period is a calendar quarter. The obligation to file a tax return is determined by law till the end of the calendar month following the end of the taxable period. In the same period the duty to pay the tax arises. If the payer does not have a tax identification number assigned, he is required to apply for registration at the latest within 5 days from the end of the taxable period for which he is required to file a tax return. The tax administrator will assign him a tax identification number as well as a taxpayer's personal account within 10 days from filing the application for the registration.

- The payer of the insurance is obliged to keep the records based to the individual tax periods and in the legally determined extent.

2 Clarification and determination of taxation and accounting of cryptocurrencies based on the enacted Tax Insurance Act

By the enactment of the Tax Insurance Act, the individual provisions of Act no. 431/2002 Coll. on Accounting and Act No. 595/2003 Coll. on income tax which will help to clarify the conditions for accounting and taxation of cryptocurrencies/virtual currencies with effect from 1st of October 2018:

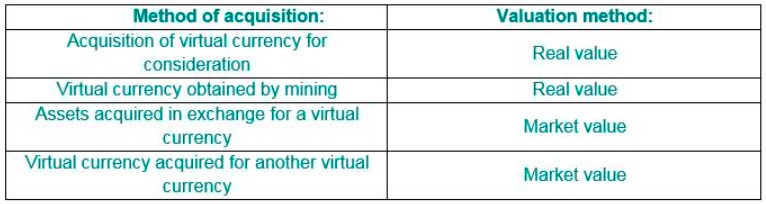

- The virtual currency is valued in the accounting at real value. The real value for a virtual currency is considered to be the price found in the public market in a way chosen by the entity. The virtual currency valuation will be used for the first time during the preparation of the financial statements at 1st of October 2018. The summary of the virtual currency valuation, depending on the method of its acquisition, is illustrated in the table below:

- From the accounting point of view, a virtual currency is considered an asset, specifically defined as a short-term financial asset other than cash.

- It is necessary to distinguish the moment of revenue/income recognition separately from the sale and separately from the exchange of virtual currency. When selling a virtual currency, it is booked as revenue/income at the time the transaction is confirmed in the blockchain and in case of the exchange of the virtual currency at the time of the two transfers.

- The virtual currency should be recorded in the EURO currency for the purposes of preparing the financial statements, the exchange differences due to the revaluation in the end of the taxable period should not be accounted for.

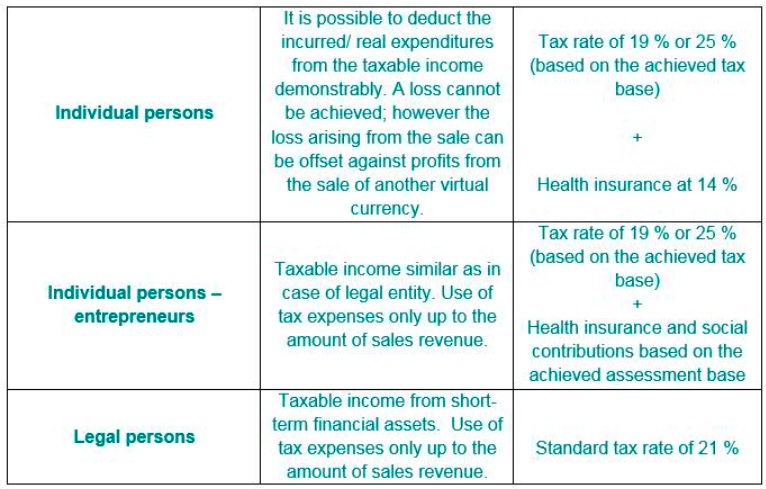

- Taxation of income from the sale of cryptocurrencies is considered under the applicable Income Tax Act. Below we provide you a brief overview:

- From the value added tax point of view, the purchase and sale of the virtual currency for the purpose of its future valuation is considered a taxable transaction. Since they are regarded as the financial services, the purchase and sale of the virtual currency is exempt from value added tax.