Changes in the Labor Code in relation to the coronavirus pandemic II.

In yesterday's article, we brought you changes in the Labor Code in labor law area. If you missed it, you can find it HERE. Also the following article will be devoted to the Labor Code, but this time from the social field.

SOCIAL INSURANCE AREA

Quarantine OČR - nursing is a sickness benefit, which is provided to an insured person who personally and day-long treats a sick child or cares for a child up to 11 years of age personally and all-day care is provided to the child, it has been closed by decision of the competent authority.

The amount of nursing is 55% of DVZ / gross monthly income.

Only the insured person is entitled to the sickness benefit, ie. person who is currently sickness insured (employee, compulsory sickness insured self-employed person or voluntarily sickness insured person), respectively her / her withdrawal period after sickness insurance expires.

The parent of a child under 11 years of age (10 years + 364 days) was currently able to claim sick leave from 16.03.2020 to 29.03.2020, ie. j. 14 calendar days.

If the state of emergency persists after this deadline, the parent of a child under 11 years of age does not have to re-apply for nursing from 30.03.2020, as the Social Insurance Agency will do so automatically, without the application.

However, if another parent wishes to claim nursing, he / she must submit a new application for nursing. If parents need to be replaced by the CRC, they can do so no later than 10 days, and they must notify the Social Insurance Agency of their commencement of employment no later than the end of the calendar month.

In the case of a child who is 11 years or older - until the age of 16 - he / she needs a medical certificate. It is necessary to contact the pediatrician who issue an application for nursing due to the child's unfavorable health condition and send it to the Social Insurance Agency. Subsequently, the Social Insurance Agency proceeds according to the above points.

Quarantine PN - The amendment to the Social Insurance Act enters into effect on 27.03.2020 payment of the so-called. quarantine PNs, which have been paid by the Social Insurance Agency since the 1st Calendar Day, in the amount of 55% of DVZ / gross monthly income; the physician decides whether the PN is quarantine.

Deferred payment of social security contributions - insurance premiums payable by the employer or compulsorily sickness insured and compulsorily retired insured self-employed who show a decrease in net turnover or income from business and other self-employment by 40% or more for March 2020 is due by 31 July 2020, even if, at the time the premium is paid, the premium payer is no longer an employer or compulsory sickness insurance and a compulsory pension for self-employed persons.

Unemployment benefit - in the area of social insurance, the Labor Department wants to provide income to people who receive an unemployment benefit by temporarily extending their support period by one month because they are unable to find a job in times of crisis.

IMPLEMENTATION OF CONTRIBUTIONS FROM ÚPSVaR

The government has taken two basic measures to support employee retention:

1. Measure for employers who were obliged to close their retail outlets (ie employers whose operations must be closed and whose employees are at home because the employer cannot assign them work):

• The state pays these companies 80% of the average monthly earnings of employees, up to a maximum of EUR 1100, while the minimum wage must be respected.

• It is necessary to apply for a contribution at the relevant labor office.

2. Subsidies for employers (for their employees) and for self-employed persons (self-employed) whose turnover has decreased (this applies to employers and self-employed who did not have to cease their business but whose turnover decreased compared to in 2019 and at the same time his employees are at home, because the employer cannot assign them a job):

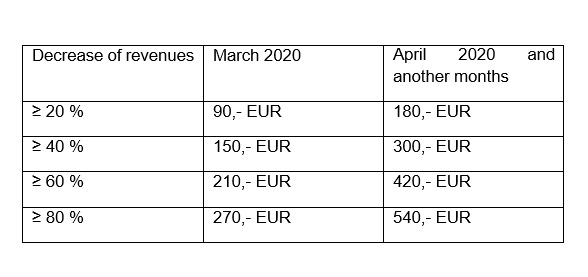

The state will reimburse these companies contributions depending on the decrease in the company's revenues

The amount of the contribution is as follows:

• Contribution amount is max. EUR 200,000 per month for one company.

• The maximum total contribution per applicant is EUR 800,000.

It is necessary to apply for a contribution to the relevant labor office. Only entities established and started to operate by 1 February 2020 at the latest may be eligible for contributions

An employer who has paid employees compensation of 60% of their average earnings will be taken into account when paying for the relevant period, max. the amount of 880, - Eur.

For employers or self-employed employers to be eligible, they must:

- pay the employee compensation of 80% of his average earnings

- a commitment not to terminate the employment relationship with the staff member two months after the month for which he is applying for the allowance,

- present the number of employees by 31.3.2020,

- as of 31 December 2019, it was not in difficulty with a company (also applies to self-employed persons).

- has fulfilled tax obligations according to a special regulation,

- has fulfilled the obligations to pay advance payments for public health insurance, social security contributions and compulsory old-age pension savings contributions,

- has not breached the prohibition of illegal employment within the two years preceding the application for the allowance,

- has no financial obligations to the Authority,

- is not in bankruptcy, liquidation, receivership or has no payment schedule specified in a special regulation,

- has no registered unsatisfactory entitlements of its staff resulting from employment,

- has no legal penalty for the prohibition of receiving subsidies or subsidies, or a penalty for the prohibition of receiving assistance and support provided by European Union funds, if it is a legal person.

These facts prove the employer, respectively. The self-employed person's affidavit and all facts that the applicant proves with an affidavit will be subject to subsequent inspections.

APPLICATION FORM

Employee reporting

As part of the application process, you will be asked to enter a list of employees to whom the employer pays a contribution for the month.

CONCLUSION:

We are constantly monitoring the situation and we will inform you in good time about new facts. If you have any questions or requests, please do not hesitate to contact VGD SLOVAKIA s.r.o. or VGD Legal s.r.o., who will be happy to advise you in these areas. Find more information about services on our website, Facebook or Linked-In.

Disclaimer: The information provided to the Client is up to date as of 16.03.2020, it is for informational purposes only and does not replace any legal service pursuant to Act No. 586/2003 Coll. on Advocacy. VGD Legal s.r.o. does not assume liability for the completeness and accuracy of the information referred to in the paper. In case of questions about the information provided to the Client, the customer may ask VGD Legal s.r.o. for provision of legal services for this purpose.

Najnovšie správy

Zjednodušenie podnikových reštrukturalizácií. Čo prináša nový zákon o premenách obchodných spoločností?