Package of taken measures – “podnikateľské kilečko “

Based on the adopted legislative changes that are amending the current legislation in order to improve the business environment affected by the measures related to the prevention of the spread of COVID-19 (Lex Korona measures for entrepreneurs), there was also amended the law on certain extraordinary measures in the financial area related to the spread of dangerous contagious human disease COVID -19, as well as the Income Tax Act, the Tax Administration Act, the Accounting Act, the Social Insurance Act and other laws.

The legislative provisions bringing several changes that will make life more easier for entrepreneurs. These include increase of the threshold for mandatory financial audits, simplifying energy audits, considering the real fuel consumption or abolishment /reduce of various penalties. Legislation should be more predictable – tax - contributions provisions will be changed only once a year, with its effect from 1 January of the respective year.

The amendment to the Act regulates the following provisions for the area of taxes and levies.

1. Increasing the limit for the application of expenditures concerning fuels as tax expenditures

As tax expenditure will be considered the expenditures on the consumed fuel according to the prices valid at the time of purchase, calculated based on the consumption stated in the certificate of registration, technical certificate or additional data from the manufacturer or seller, and this consumption can be automatically increased by 20% without any obligation to prove and investigate this higher consumption.

This means that the consumption resulting from the technical card is automatically increased by 20%. Thus, is achieved more realistically volume of consumption, i.e. the recognition of a larger amount of tax expenditures in this matter of applying of expenditures on fuel consumed (the other two methods remain unchanged).

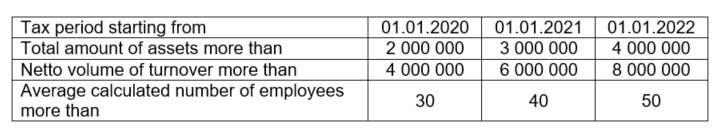

2. Increasing the size criteria for the statutory audit of companies' financial statements

There have been adjusted the conditions based on which an entity must obligatory audit its ordinary or its extraordinary individual financial statements. The change of criteria should be applicable to all assessed parameters, and these will be changed for the individual accounting periods, as follows:

3. Extension of the deadline for commenting on the tax audit protocol

The minimum period to comment the tax audit report is extended from the current 15 working days up to 30 working days from the delivery date of the report. The longer period will be applicable for the first time to those protocols that are drawn up by the tax authorities after 30 June 2020.

4. Changes in the Social Insurance Act

- Abolishment of the employer's obligation to unsubscribe itself from the register of employers that is kept by the relevant branch, in case that he does not employ any employee. The social insurance company terminates the registration of the employer automatically, based on the deregistration of the last employee by the employer.

- Abolishment of several obligations for employer, e.g.:

- the changes of individual personal data of an employee (e.g. surname, name, status and change of his permanent seat, etc.….)

- the change of information regarding the starting date of employment and its termination or any other legal relationship to employer

- the start and termination of maternity leave or parental leave of his employee

- The deadline for fulfilling of employer's obligation to submit an evidence to the Social Insurance Agency is extended in the case that an employee has terminated his working contract with his employer. The new period will be valid till the end of the calendar month following the month in which the employment relationship has terminated.

- The Social Insurance Agency will not impose any fine for the breach of the obligation, related to registration of persons into the register of the insured persons and savers of the old-age pension savings scheme, in the case that the person fulfils this obligation within seven days of the expiry of the statutory period.

5. Changes in the law Lex Korona

In case that the amount of tax prepayments which are due from the beginning of 2020 tax period to the end of the period for submission of CITR 2019 are lower than the amount of tax-prepayments resulting from 2020 CITR, the taxpayer will not be obliged to pay the arisen tax arrears. This shall be applicable for the taxpayer with the taxable period a calendar starting on 1 January 2020 as well as for other taxable period.

The above change is just one of many. If you want to be informed about any further changes in the law of Lex Korona, do not hesitate to contact our experts! You can also do so via the e-mail address support.covid19@vgd.eu.

6. Deferral of payment of levies

In addition to the above-mentioned provisions, the Government of the Slovak Republic has adopted also other regulations for the employers that are reporting a decrease in their netto turnover by at least 40% concerning the months of June and July 2020. These employers may postpone the due date for the payment of social insurance contributions for these months. The Regulation related to the postponement of contributions for June 2020 was published in the Collection of Laws and has already entered into the force. The second regulation was currently approved by the government on the last meeting. Insurance contributions and prepayments on insurance contributions, that are paid by the employer for his employee, are still due on the original due dates. Also, there is not affected the obligation to submit relevant declarations.

The above-mentioned information is current from 17.7.2020 and has only general nature. The information does not contain all the details and specific situations in which you might find yourself.

If you need advice on this issue, we will be happy to help you. Write to us at support.covid19@vgd.eu. You can find other useful articles and information on our website, Facebook and Linked-In.

Najnovšie správy