Wage quantities for the year 2021

The new year 2021 brings, in addition to legislative changes, also changes in wage variables!

With effect from 1 January 2021, the minimum wage will be 57% of the average monthly nominal wage of an employee in the Slovak economy published by the Statistical Office of the Slovak Republic for the calendar year two years preceding the calendar year for which the monthly minimum wage is determined.

Ie. 57% of the average wage for 2019, which was set at € 1,092 (originally 60% of the average wage was set):

• € 623 per month for an employee paid a monthly salary,

• € 3,580 for each hour worked by the employee.

• The employer is obliged to provide his employees in an employment relationship for the work performed in the amount of the minimum wage entitlement determined for the degree of difficulty of the respective job.

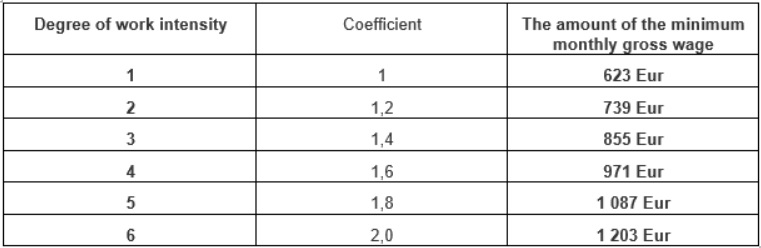

Even in 2021, six levels of work intensity remain in force, but there is a change in the calculation of individual wage claims (Section 120 (4) of the Labor Code).

The amount of the minimum wage entitlement of the employee remunerated by the monthly wage for the relevant grade for the relevant calendar year is the sum of the difference between the amount of the monthly minimum wage determined for the relevant calendar year and the amount of the monthly minimum wage determined for 2020 wages.

Weekly working hours 40 hours / week pay these amounts

Surcharges - wage benefits for 2021

The amending law not only changes the calculation of the minimum wage and minimum wage claims, but also abolishes the calculation of surcharges and introduces fixed amounts for surcharges from 1 January 2021.

Work on Saturday

CANCELED = at least 50% of the minimum wage in euros per hour,

A FIXED amount of € 1.79 is set.

Work on Sunday

CANCELED = at least 100% of the minimum wage in euros per hour,

A FIXED amount of € 3.58 is set

Night work (work performed between 10 pm and 6 am)

CANCELED = at least 40% of the minimum wage in euros per hour,

A FIXED amount of € 1.43 is set.

CANCELED = in the case of an employee performing hazardous work, at least 50% of the minimum wage in euros per hour,

A FIXED amount of € 1.79 is set.

CANCELED = for an employer for whom, due to the nature of the work or operating conditions, the predominant part of the work is required to be performed as night work, a lower amount of wage benefit may be agreed, if not an employee performing risky work, but at least 35% minimum wage in euros per hour,

A FIXED amount of € 1.25 is set.

Work on a holiday

If the employee performs work on a public holiday, he / she is legally entitled to a wage benefit of at least 100% of his / her average earnings, in addition to the salary he / she has achieved.

Supplement to work for the holiday - agreement on work performed outside the employment relationship - 100% of the minimum hourly wage € 3.58

Overtime

25% of his average earnings,

35% of his average earnings in the case of an employee who performs hazardous work.

Inactive on - call duty outside the workplace

CANCELED = for the time of the inactive part of on-call time outside the workplace, the employee is entitled to compensation in the amount of at least 20% of the minimum wage in euros per hour.

A FIXED amount of € 0.72 is set.

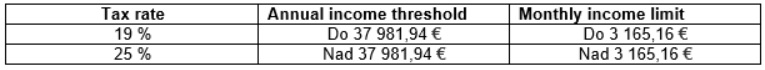

Payroll tax

Tax base and tax rate from dependent activity for 2021

The amount of the non-taxable part per taxpayer in a monthly application is € 375.95

When providing non-monetary benefits also for private purposes (car, mobile phone, etc.), we pay attention to your employees that they are subject to the calculation of the tax on dependent activity and contributions to the social and health insurance company.

For more information, whether the assessment of non-monetary benefits for private purposes, do not hesitate to contact us

Tax bonus per child for the year 2021

The monthly amount of the tax bonus for a child from 6 years is € 23.22, for a child under 6 years it is € 46.44

Social and health insurance premiums for 2021

The minimum assessment base of an employee / employer is not set by the Act on SP. Only the amount of the maximum assessment basis is set and it is increased to the amount of € 7,644 with effect from 1 January 2021.

The amount of the maximum assessment base is not determined by the Act on ZP.