Labour Code - Modification from May 1st 2018

On May 1st 2018 an amendment to the Labour Code and related acts will come into force. Below we have selected for you the most important changes caused by this amendment:

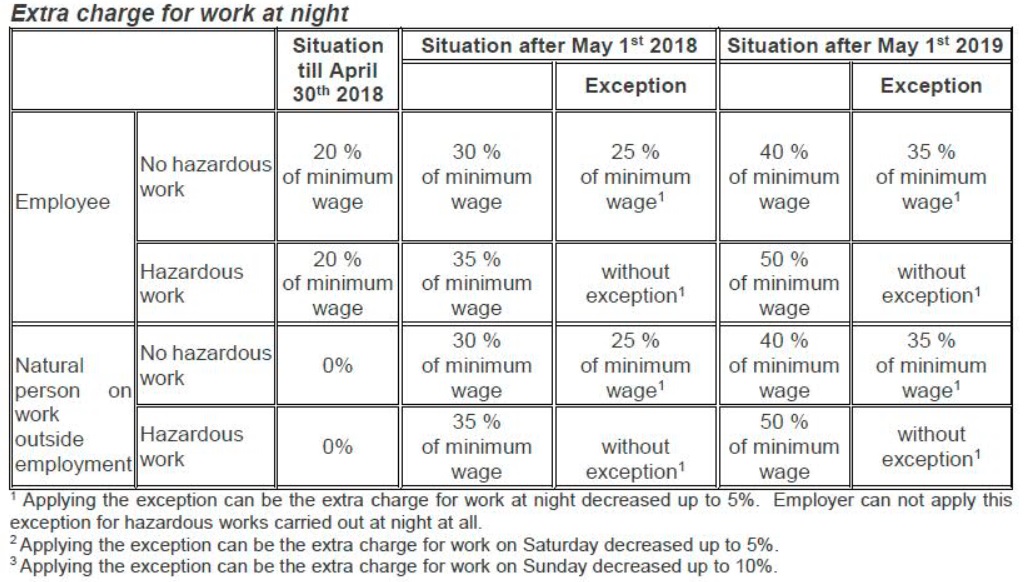

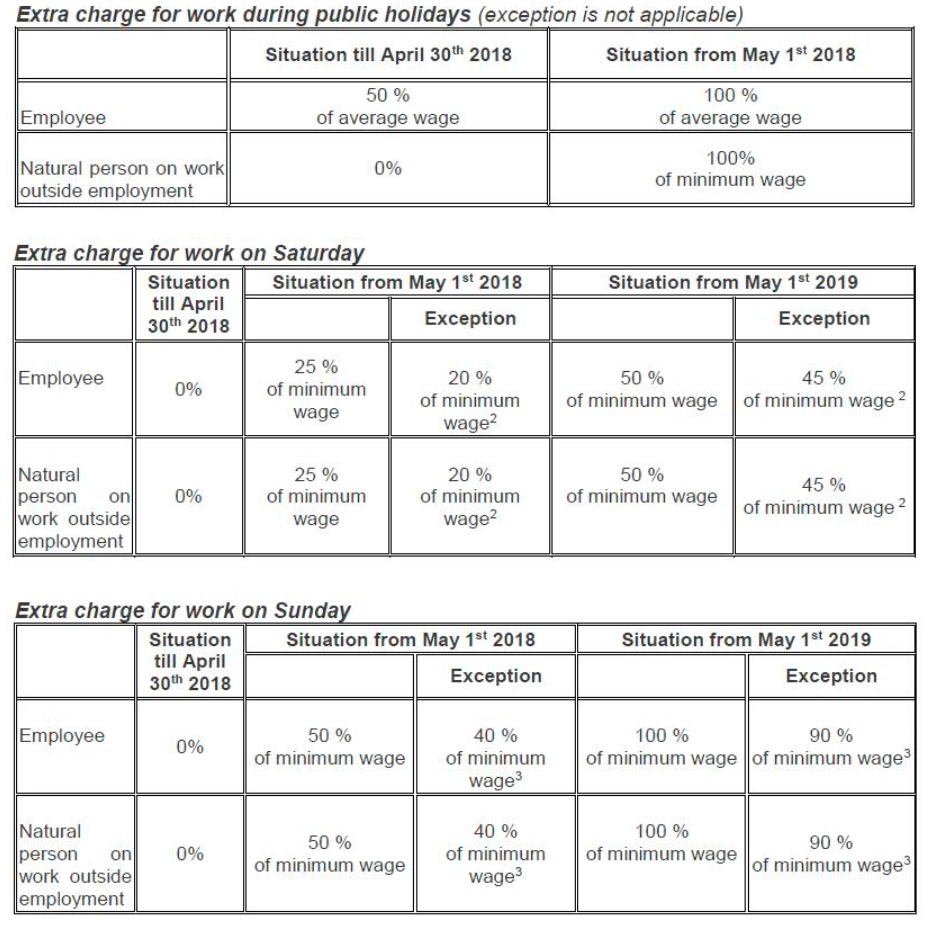

Increase of the extra charges for the work at night, on public holidays and during weekends

The extra charges will be increased in two phases: one as from May 1st 2018 and the second as from May 1st 2019. At the same time several exceptions will apply for those employers, where night work is predominant. For the night work the amount of extra charge will depend on the fact if it is hazardous work or not. The amount of the extra charge is determined as the percentage of the minimal wage or the average income in accordance to the kind of extra charge. Extra charges will be applied for the employees as well as for natural persons on work performed outside an employment relationship (further referred to as ‘Agreements’).

Exceptions from the increase of extra charge from 2018 and from 2019: Employers will be able to modify the increase of extra charges for work at night, work on Saturday or on Sunday via collective agreements with the trade unions or directly in the labour contract with an employee, but only if no trade union organisation is operating at the employer and simultaneously the employer has employed less than 20 employees. This exception can be applied only by employers, where the work at night or work during weekend is predominant. Such exception, however, cannot be applied for work on public holidays.

The amount of extra charges and amount of extra charges after decrease are shown in the table below.

Implementation of the 13th and 14th wage (summer and Christmas bonus)

The amendment also introduced the concept of a 13th and 14th wage, albeit on a voluntary basis.

In order to smoothen the impact of this decision, the government has introduced a possible exception of the social contribution and tax on these payments. To apply for a tax and social contribution allowance, an employer has to fulfil the following conditions:

- 13th and 14th wage must be minimally in the amount of the average monthly income of the employee,

- The allowance may be applied maximally from the sum of 500,- EUR; for the employee this 500,- EUR is the total of incomes from all employers,

- 13th wage must be paid by the employer in June,

- 14th wage must be paid by the employer in December

- employees, to whom is being paid the 13th wage have to be employed as of April 30th of the relevant year continuously for at least 24 months,

- employees, to whom is being paid the 14th wage have to be employed as of October 31st of the relevant year continuously for at least 48 months,

- for the payment of the 14th wage has to be met the condition of payment of the 13th wage

Exemption from the tax duty can be enforced for the first time:

-

by the 13th wage in June 2019

-

by the 14th wage already in December 2018, but only under condition, that in June 2018 was employee paid with the 13th wage, which was at least in amount of average income (without tax liberation)

Exemption from the contribution to the health insurance can be applied for the first time in 2018 and the exemption from the social contribution can be enjoyed for the first time in 2019.

3. Obligatory publishing of offered wage in job advertisements from May 1st 2018

The employer is obliged to publish in job advertisements the sum of the basic component of the wage. After the conclusion of the labour agreement, the employer is obliged to provide to employee minimal the wage that he had offered in his job advertisement.

4. Regulation of the temporary work performance of employees for employer established outside the EU

The amendment of the Labour Code has levelled the posting of employees from the EU and from outside the EU. Also an employer established outside the EU, who temporary posts his employees to the territory of the Slovak republic has to respect the essentials of the Labour Code, mainly the minimal wage. Simultaneously can an employer established outside the EU use the exceptions, when there is no posting of employees.

In case of need of preparation of amendments to labour contracts or advisory in field of tax, social and health contribution allowances connected to the 13th and 14th wages, we will be pleased to provide you with our professional advisory and we will secure for you all necessary support.