What will be the tax bonus for a child in the new year?

The beginning of the New Year brings with it several changes. In connection with a change in the subsistence level, the amount of the tax bonus increased to EUR 23.22 for each dependent child living in the same household with the taxpayer, while the child's temporary stay outside the household does not affect the application of this tax bonus.

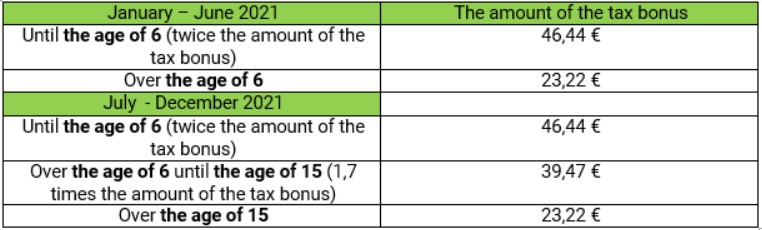

If the dependent child has not reached the age of six, the amount of the tax bonus is twice the amount of EUR 23.22, i.e. EUR 46.44. The taxpayer can claim the increased tax bonus for the last time in the calendar month in which the dependent child reaches the age of six.

Entitlement to the tax bonus arises for a taxpayer who in the tax period has achieved taxable income from dependent activity or has achieved taxable income from business and other self-employed activity in the amount of at least 6 times the minimum wage.

Entitlement to the tax bonus of a taxpayer with taxable income from dependent activity (employee):

- annual income of at least EUR 3 738 (6 times the minimum wage) and more.

Entitlement to the tax bonus of a taxpayer with taxable income from business and other self-employed activity

- annual income of at least EUR 3 738 (6 times the minimum wage) and more,

- recognition of the income tax base, i.e. no tax loss can be recognized.

With effect from 1 July 2021, the amount of the tax bonus will increase to 1.7 times this amount for a dependent child who has reached the age of 6 and has not reached the age of 15, for the last time in the calendar month in which the dependent child reaches the age of 15. It can therefore be said that the tax bonus for compulsory school children will increase. The total amount of such increased tax bonus will be EUR 39.47 (1.7 times the amount of EUR 23.22). From 1.1.2022, the tax bonus for this category of dependent children should increase to 1.85 times the amount of the tax bonus.

The amount of the tax bonus for individual age categories is shown in the following table:

For the most up-to-date information we recommend you to follow our Facebook page, Linked-In or website.